Credit reports are extremely important files that can make a big difference to the ability of any adult to get finance of any sort, ranging from credit cards and loans to car finance and mortgages. In fact, the state of your credit report can affect many other areas of your life such as being able to rent a property and in some cases getting a job.

This is why it is advisable for anyone to check their credit report on a regular basis to ensure that it is not being adversely affected by things such as inaccurate or out of date information. This also enables you to keep your eye out for suspicious transactions that could indicate identity fraud and enables you to monitor your progress if you are trying to improve your credit.

What is included in the statutory credit report?

Statutory credit reports are free to access and include a basic view of your credit history including 6 years of your credit accounts. It will also include any late payments or if you have defaulted on loans, CCJ’s (County Court Judgements), IVA’s (Individual Voluntary Arrangements) and Bankruptcy orders.

How to access Your Statutory Credit Reports

|  |  |

|

|

|

Credit reference agencies are able to provide you with a copy of your statutory credit report via a number of methods. Legally, everyone in the UK has a right to access these reports (hence the name statutory). However, you cannot access them on behalf of someone else – you can only request a copy of your own credit report.

When it comes to accessing your statutory credit report there are a number of options open to you. The most convenient and speediest method is to order your report online, which will give you instant access to the information so you can start going through the details without delay. If you prefer you can have the credit report posted out to you and you can do this by either sending a request online or by printing off the application form and sending it along with the payment.

What is not included in your Statutory Credit Report?

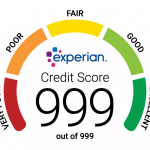

Your credit score is not included so that must be accessed via a paid monthly service, for Experian via their free (score only) account or via partner services that provide both (Clear Score, Credit Karma or Checkmyfile for example).

Are pay monthly services that include credit score and credit reports better?

Another option open to those that want regular access to their credit reports is to go for the pay monthly option. This is particularly useful if you want to track an improvement to your credit score over time for example but less helpful if your credit score is excellent.

With the statutory credit report you are simply sent your report via your chosen method and you can then do with the information what you will. However, when you opt for the pay monthly service you get an actual service rather than just a copy of your credit report.

When you opt for a pay month service for your credit report you will normally get a thirty day free trial, which means that you can see whether the service is for you. If you cancel your subscription within that free trial period you do not have to pay anything. If you decide that you would like ongoing access to your credit report you will be charged a set fee each month, which will be taken from the credit or debit card that you designate. The paid credit score and report services will also show you whether your credit rating is poor, fair, good, or excellent, and will also show you exactly what the actual score is normally up to 999 depending if it Experian, Equifax or TransUnion.

One of the great things about these pay monthly arrangements is that you can cancel at anytime, so you don’t have to worry about being tied into any long term contract or commitment. This means that you can receive the credit report for a few months, cancel, and then start again a few months down the line if you wish. The service is totally flexible, and for those that want to keep a close eye on their credit can represent great value for money.

The benefits of pay monthly reports compared to statutory reports

Whilst receiving one off statutory reports can be very good for those that just want to have a quick check of their credit report and information there are many benefits that are offered by the pay monthly credit report service compared to the one off statutory report. This includes:

- With the pay monthly arrangement you get an actual service rather than just a credit report

- You will have access to customer services to address any issues and problems

- You can get 30 days free access to ensure that this service is right for you, with the ability to cancel at any time within that period and be charged nothing

- You can continue with the pay monthly arrangement for as long as you like, with the ability to cancel at anytime without the need to commit on a long term basis

- You can get free advice relating to your credit report and score with tips to help you improve your rating

- You can get email alerts with regards to any changes that have occurred on your credit file

- You can access your actual credit score online, enabling you to see whether your rating is poor, fair, good, or excellent, and what your actual credit score is.