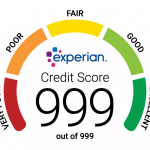

Credit reports are your financial identity and in the UK are maintained and developed by the three key credit agencies, which are Experian (Credit Expert), Equifax and Transunion. Credit Reports contain a detailed insight into your credit/payment history, sometimes a credit report, is also described as your credit file. The content of your credit report, will determine the credit rating or credit score the credit agency gives you. You will have a credit report, as long as you are 18, and have some credit in the uk.

Financial lenders use Credit Reports

Credit Reports, are important and ultimately worth paying for as lenders, use credit reports, from one of the main UK credit agencies, described above, to make a decision on whether to lend to you or not. They use your credit report along with details on your application such as your salary to work how much of a risk you are and if you will are more likely to not pay back the credit. They will also use information in your credit report to determine an interest rate on the credit, they offer you.

How to get a Credit Report

Simply sign up with Experian, Equifax and Transunion to gain access, to your free credit report.

Why would you pay for access?

- When applying for credit – alot of people check their credit report when they get rejected for a financial application, but they should check it before.

- When switching jobs or looking to move home – in both cases a credit check (reviewing your credit report) with your permission, can be part of the process, particularly when looking to rent or buy a home.

- Victim of Identity fraud – sometimes people get a letter or a call about a credit product they did not apply for, your credit file will reveal if applications have been made in your name.

What kind of information is included in your Credit Report?

Credit Account Information:

This part of the credit report includes details of your credit arrangements with the relevant financial lenders, for example mobile phone accounts, current accounts, mortgages and credit cards and now utilities. It also shows for each account the balance of any outstanding credit, and any late payments.

Electoral Roll Information:

This shows the dates that your name was registered on the electoral roll, and the address associated with your name, when you registered.

Financial Associations:

This section shows the details of anyone you are financially connected to. These are created when you participate in joint applications, such as for a joint current account or a mortgage.. This is common with spouses for example.

Public Record Information:

This section of your credit report contains information on any IVA’s (individual voluntary arrangements), county court judgements (CCJ’s) and bankruptcies.

Prior Searches on your Credit File:

This shows the organisations that have viewed some or all of the information in your credit report, within the past 12 months. Most of the searches will be in relation to finance applications you have made, and should have been performed with your consent.

Repossession Details:

This section will show if you are showing on the council of mortgage lenders (CML) information in reference to having given up your home or it being repossessed. CML information can be noted on up to three addresses.

Prior Searches on your Credit File:

This shows the organisations that have viewed some or all of the information in your credit report, within the past 12 months. Most of the searches will be in relation to finance applications you have made, and should have been performed with your consent. This can also include checks by lenders you already have credit with.

Quotations, unrecorded enquiries, credit report applications and identity verification checks are shown to you but are not seen by lenders checking your credit report.

Financial Associate Searches:

These searches show when someone you are financially associated with made an application for credit, and the lender, reviewed your credit report information. Other lenders cannot see this information it is just for you.

Linked Addresses:

Linked addresses are included in your credit report, when you tell a current lender, that you have moved address, or when a lender receives an application including multiple addresses.

CIFAS

CIFAS, is the UK Fraud Prevention Service, with 265 members, constituting key lenders in the UK. CIFAS, key aim is to protect innocent members of the public from prejudice if they have been the victim of identity fraud. This can display information if for example a lender which is a member of CIFAS, puts an entry of your credit file, on your behalf.

GAIN

GAIN stands for Gone Away Information Network, which is an organisation. This credit report section shows that a person has outstanding credit and has changed address without informing the lender, they have borrowed the finance from. This information is updated by the organisations who are members of GAIN. GAIN information is automatically removed from your credit report six years from the original date of repossession.

Does everyone have a Credit Report?

If you are 18, and have every had any credit in the UK, then credit reference agencies are likely to have information on you contained in a credit report. If you are new to the UK, or never had any credit, then you may not have a credit report, but it is possible to start building one straight away.

How do you Get a Credit Report?

It is possible to obtain your statutory credit report (one off) or access to your ongoing credit report (recommended), the goal being to correct any mistakes (you can query elements of your credit report with lendersy), and clean up your credit file, as banks are very risk averse in the current climate this is even more important right now. It is worth checking your credit report, before applying for any finance, and if you are rejected for any credit products.