Your credit score (also known as a credit rating) is a number which determines your credit worthiness or risk for lenders. This determines wether you are successful in applying for products such as Mortgages, Credit Cards, Car finance, Loans, or Mobile Phone Contracts. Credit Score Ace is a website designed to provide you with objective information and advice about your current credit status, to help you boost your credit rating, and gain access to the credit you want – at the interest rate you deserve.

Why Bother Improving your Credit Rating?

Basically to save money, by obtaining better finance products (stop wasting money on high cost finance, think high APR’s), and stop getting rejected when you apply for finance products, which further damages your credit rating. This is even more important in a challenging economic environment when lenders are highly risk averse with their lending, and it is thus easy to be rejected.

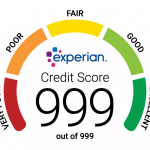

In the UK the three main credit bureau’s are Experian, Equifax and TransUnion.. We all have a Credit Rating Score and it is often out of a thousand, and varies between the credit agencies. The credit agencies offer free credit reports, which allow you insight into the specifics, of your credit file or credit history. Credit Score Ace compares the content of the free online credit reports.

It is worth checking your free credit report, as it is not static and changes, depending on your financial applications and activity with current accounts, such as payments on your credit card. There can be elements of your credit file, which you would contest, if you knew about, so that other lenders, do not mistakenly hold something against you.

Once you understand that checking your free credit report is very important so you know where you stand at a particular moment in time. Your credit report is also important for monitoring your improvements to your credit rating. The following tips are some basics that you can action immediately and on going to protect your credit rating score and improve it over time:

- If you are rejected for credit do not keep applying for similar products, speak to the lender and find out why they rejected you and check your credit report. Multiple applications lead to multiple searches on your credit file, which can look like identity fraud, thus making lenders weary of your application.

- Always pay your current financial arrangements on time, if you can pay them off early do so, use direct debits or standing orders, to guarantee, punctual payments.

- Make sure your current address is on the electoral roll, contact your local council to register for this, lenders check this versus what is on your application.

- You need credit to get credit, so use some credit regularly, such as a credit card, always pay on time, this shows a reliable payment history.

- Cancel any accounts or finance products you are not using, try to retain only the credit you use regularly such as your current account or credit cards.

- Do not use the maximum credit limit you are allocated, lenders may question your ability to make payments.

- Avoid CCJ’s (County Court Judgements) as these can have a seriously negative impact on your credit score. If you have a CCJ, try to pay it within one calendar month and then it will be removed from your credit report. If it is paid in full make sure it is shown as satisfied on your credit report.

- End Financial Associations that negatively impact you, for example if you have split from a partner, and your partner has a poor credit rating and is connected to you through a joint application such as a joint bank account, contact the relevant credit agencies for a dissociation form.

- Check your credit report regularly, query any irregular information with the relevant lender, set-up alerts related to your credit report, which updates via email of any changes to your credit report. For example an application made with your details but not by yourself, alerts you to identity fraud early.

- Use Notice of Corrections, these are notes you can add to your credit report. For example if you were late with certain payments, due to redundancy or a divorce, a lender must take these into consideration, and are important if you are paying on time again.

How do you know if your credit rating has improved?

Once you have followed the key steps you will need to find out your credit rating or credit score, from the key UK credit agencies including Experian’s Credit Expert, Equifax and TransUnion. Once you access your free credit report, you can then pay for your credit score. Following the steps above it can take months to improve your credit rating but it is worth dedicating yourself to this.

It may be worth checking your score twice a year or just before finance applications, knowing this score will also help you apply for suitable finance products. If you understand for example you have an average credit rating you would not then apply for high credit score only product. Check your free online credit report now and learn strategies to improve your credit score with Credit Score Ace and save money today!